salt tax deduction calculator

Using Schedule A is commonly referred to as itemizing deductions. If your total is 10000 or less write the full amount on line 5e.

Supreme Court Definitively Ends The Salt Tax Deduction Case

The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

. If your total is more than. Though it expires in the next few years policymakers want to raise the cap much sooner to. The federal tax reform law passed on Dec.

It is mainly intended for residents of the US. If you paid 5000. Add up lines 5a 5b and 5c.

The unlimited SALT deduction allowed millions of Americans to use state and local tax bills to reduce federal taxes on a dollar-for-dollar basis. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. No cities in the Beehive. Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file.

Utah has a very simple income tax system with just a single flat rate. Before the creation of a cap on this deduction 91 of the benefit of the salt. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

And is based on the tax brackets of 2021 and. Sales Tax Deduction Calculator. But you must itemize in order to deduct state and local taxes on your federal income tax return.

A Democratic proposal aims to restore the SALT deduction for taxpayers who make. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. Second the 2017 law capped the SALT deduction at 10000 5000 if.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The current SALT deduction cap remains at 10000 under the Tax Cuts and Jobs Act of 2017. List your state and local personal property taxes on line 5c.

But you must itemize in order to deduct state and local taxes on your federal income tax return. 52 rows The SALT deduction is only available if you itemize your deductions. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Our Resources Can Help You Decide Between Taxable Vs.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Don T Miss The Election For The Salt Cap Workaround

What Do They Mean By The Salt Tax Deduction Personal Finance Buffalonews Com

Why Repealing The State And Local Tax Deduction Is So Hard

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

What Is Salt Tax Deduction Mansion Global

What Do They Mean By The Salt Tax Deduction Crossroads Today

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Deduction Tips For Airbnb Hosts Shared Economy Tax

Debate On State And Local Tax Deduction Ignores Its Origins The Hill

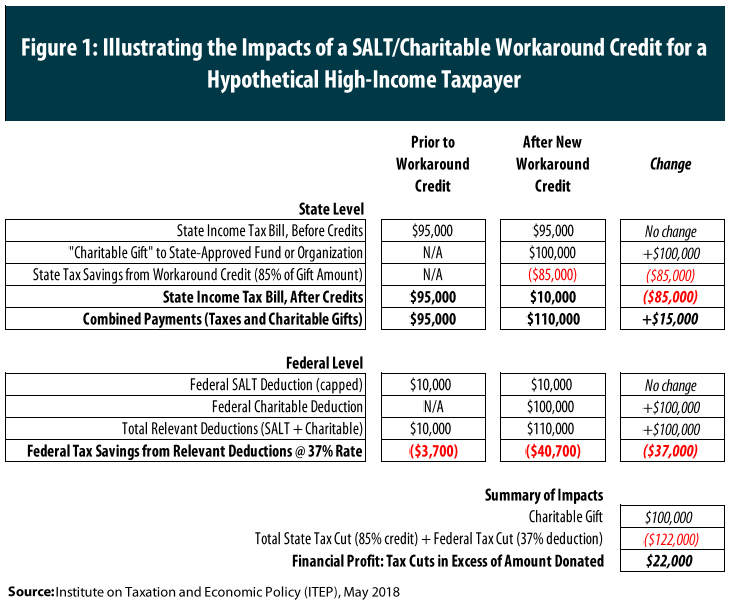

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep