starting credit score in india

Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number. Best personailzed offers for loans and credit cards.

How Much Is Cibil Score Required To Finance Your Car Credit Score Bad Credit Score Scores

Starting credit score in india Thursday May 5 2022 Edit.

. From a banking perspective this is the start. After 6 months however you will finally have a score. Majority of those who get a loan have a score of 750 and above.

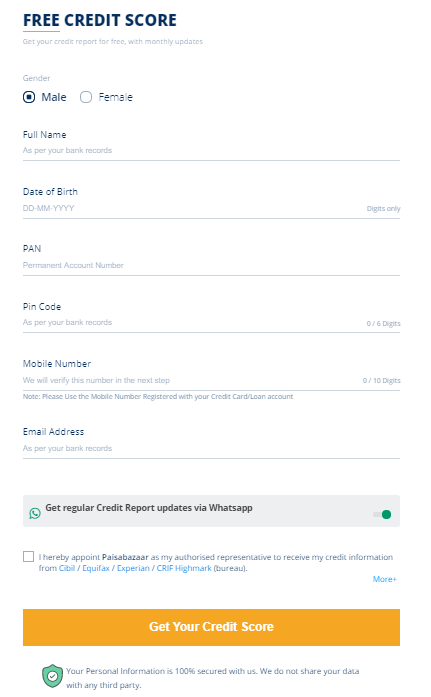

Free monthly credit score updates. Should have a minimum credit score of 750. Top 7 Tips to Build your Credit Score Tip 1 Apply for a Credit Card.

It offers businesses a company credit report and a CIBIL rank. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period. Check your free CIBIL Score and Report and apply for a customized loan.

High Credit Score Affordable Loans. The startup has custom-built affordable finance solutions and offers these through digital channels. Your credit score.

There are seven credit rating agencies in India including CRISIL ICRA CARE India Ratings and Research Pvt Ltd Acuite Ratings Research Brickwork. Know the factors affecting credit score. If you get a credit card and start using it and pay the balance off every month which shouldnt be much then after 3 months your starting credit score of no record found will now be too new to rate.

In India CIBIL or Credit score plays a very significant role in getting any kind of loans from any lender. A credit bureau keeps a month-on-month record of your payments towards your bills and loan repayment equated monthly instalments EMIs for the past few years. We have put together a list of the 10 best credit cards in India.

Both in India and abroad. Building a credit history will start you on your way to having a. Best Credit Cards In India 2022.

A score of 700 is considered ideal. Decision sciences rest at the core of its product offerings and they extensively leverage AI capabilities. Your repayment history influences your credit score the most.

Get a credit card against FD in a bank. Learn more about credit score checking and check credit score for free with Tata Capital. SEBI Securities and Exchange Board of India authorizes and regulates all credit rating agencies in India as per SEBI Regulations 1999 of the Securities and Exchange Board of India Act 1992.

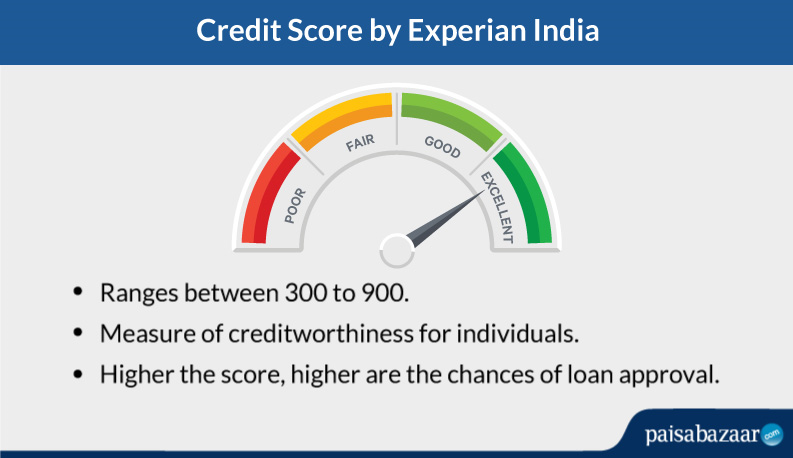

Credit score is a 3-digit number ranging between 300 to 900 where a score closer to 900 is generally considered to be a good score. For example most FICO Credit Scores range from 300-850 based on your credit history and can be viewed as a summary of your credit report. The reports take about 20 days but are not very expensive.

This score will be based on those 6 months of credit use. Get Lifetime Free Credit Score on. It was established in 2006 and it conducts analysis of credit reports on individuals and companies.

Here we explained about what is good credit score in India and cibil score check. While a score between 300 and 549 is deemed to be poor anything from 550 to 700 is deemed to be fair. Here are 5 factors that play an important role in the calculation of ones credit score.

Credit score is a 3-digit number ranging between 300 to 900 where a score closer to 900 is generally considered to be a good score. Experian one of the top 4 credit agencies in India also has a score ranging from 300 to 900. The closer the score is to 900 the better it is considered.

As you start building up a higher credit score you will soon become eligible for bigger loans such as home loans and vehicle loans from major banks in India. Its scoring system ranges from 300 to 900 with 900 being the highest and 300 being the minimum CIBIL score. Experian is a licensed credit rating agency since 2010 in India.

The more you score to achieve 900 the greater you get credit card approval process. The higher the score the lower is your risk profile and easier for you to get a loan. A good credit score is considered to be more than 750.

Focus on understanding the factors that impact your credit score and take conscious measures to improve it. CIBIL Score is a 3 digit number extend between specified limits from 300 to 900. AVAIL INTEREST RATE SUBVENTION STARTING AT 4.

Founded in 2013 by Gaurav Hinduja and Sashank Rishyasringa Capital Float is one of the leading Fintech lenders in India. It was granted its license in 2010. Scores belonging to either category can be improved.

Its scoring system is on a scale of 1 to 999 with 1 being the lowest and 999 being the highest. The credit scores rating range from 300 to 900. Banks check your CIBIL Score before approving your loan.

With a lower score you may not get a loan from a big bank but from a smaller bank or NBFC at a higher rate. Though the score ranges between 300 and 900 the average is 750. ZestMoney also offers no-cost EMI plans this.

A credit score helps lenders evaluate your credit profile and influences the credit thats available to you including loan and credit card approvals interest rates credit limits and more.

What Is A Good Credit Score Forbes Advisor

Cibil Score Full Form Meaning Login Registration Process

Different Ranges Of Credit Scores Good Bad Credit Score Range

How To Check Your Cibil Score For Free Online

Credit Score Credit Score Improve Credit Improve Credit Score

Experian Credit Score Check Free Experian Cibil Score Get Credit Report

How To Check Your Cibil Score For Free Online

All You Need To Know About Cibil Scores 2022

5 Fumbles That Can Seriously Mess With Your Credit Score In 2021

No Credit History Here Is How You Can Build One

How To Improve Your Credit Score Forbes Advisor

How To Check Your Cibil Score For Free Online

All You Need To Know About Cibil Scores 2022

The Average Credit Scores By State Show A Staggering 62 Point Gap Forbes Advisor

How To Get A Personal Loan For Low Cibil Score 5 Ways

What Is Cibil Score Or Credit Score Best Tips 2021

Experian Credit Score Check Free Experian Cibil Score Get Credit Report